European markets closed higher for the second day in a row, after the latest US inflation numbers for May came in at a two-year low, and speculation about further Chinese stimulus measures boosted sentiment. US markets followed suit, although the enthusiasm and gains were tempered ahead of today’s US Federal Reserve meeting, as caution set in ahead of the rate announcement.

Having seen the US consumer price index (CPI) for May come in at a two-year low of 4% yesterday, market expectations are for the US central bank to take a pause today, with a view to looking at a hike in July. Of course, this will be predicated on how the economic data plays out over the next six to seven weeks, but nonetheless the idea that you would commit to a hike in July begs the question, why not hike now and keep your options open regarding July, ensuring that financial conditions don’t loosen too much.

Today’s May producer price index (PPI) numbers are only likely to reinforce this more dovish tilt, if as expected we see further evidence of slowing prices, with core prices set to fall below 3% for the first time in over three years. Headline PPI is expected to slow to 1.5%, down from 2.3%.

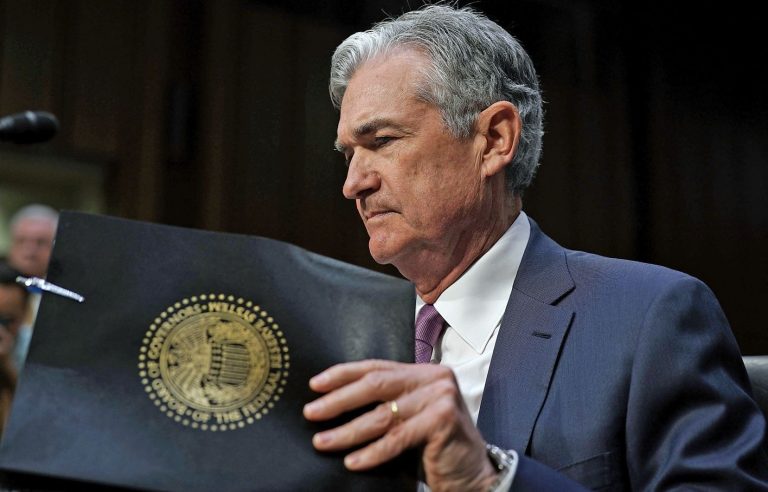

When Fed officials set out the ‘skip’ mindset in their numerous briefings since the decision in May to remove the line that signalled more rate hikes were coming, there was always a risk that this sort of pre-commitment might turn out to be problematic. So, while markets are fully expecting the Fed to announce no change today, Powell’s biggest challenge will be in keeping the prospect of a July rate hike a credible outcome, while at the same time outlining the Fed’s economic projections for the rest of the year, as well as for 2024. In their previous projections they expected unemployment to rise to a median target of 4.5% by the end of this year. Is that even remotely credible now given we are currently at 3.7%, while its core PCE inflation target is 3.6%, and median GDP is at 0.4%.

Before we get to the Fed meeting, the focus shifts back to the UK economy after yesterday’s unexpectedly solid April jobs data, as well as the sharp surge in wages growth, which prompted UK 2-year gilt yields to surge to their highest levels since 2008, up almost 25bps on the day. While unemployment slipped back to 3.8% as more people returned to the workforce, wage growth also rose sharply to 7.2%, showing once again the resilience of the UK labour market, and once again underlining the policy failures of the Bank of England in looking to contain an inflation genie that has got away from them.

This failure now has markets pricing in the prospect that we could see bank rate as high as 6% in the coming months, from its current 4.5%. The risk is that the Bank of England, stung by the fierce and deserved criticism coming its way, will now overreact at a time when inflation could start to come down sharply in the second half of this year.

So far this year the UK economy has held up reasonably well, defying the doomsters that were predicting a two-year recession at the end of last year. As things stand, we aren’t there yet, unlike Germany and the EU who are both in technical recessions. Sharp falls in energy prices have helped in this regard, and economic activity has held up well, with PMI activity showing a lot of resilience, however the biggest test is set to come given that most mortgage holders have been on fixed rates these past two years which are about to roll off.

As we look to today’s UK April GDP numbers, we’ve just come off a March contraction of -0.3%, which acted as a drag on Q1’s 0.1% expansion. The reason for the poor performance in March was due to various public sector strike action from healthcare and transport, which weighed heavily on the services sector, which saw a contraction of -0.5%. The performance would have been worse but for a significant rebound in construction and manufacturing activity, which rebounded strongly by 0.7%. This isn’t expected to be repeated in today’s April numbers, however there was still widespread strike action which is likely to have impacted on public services output.

The strong performance from manufacturing is also unlikely to be repeated, with some modest declines, however services should rebound to the tune of 0.3%, although the poor March number is likely to drag the rolling 3M/3M reading down from 0.1% to -0.1%.

EUR/USD – failed at the main resistance at the 1.0820/30 area, which needs to break to kick on higher towards 1.0920. We still have support back at the recent lows at 1.0635.

GBP/USD – finding resistance at trend line resistance from the 2021 highs currently at 1.2630. This, along with the May highs at 1.2680 is a key barrier for a move towards the 1.3000 area. We have support at 1.2450.

EUR/GBP – has slipped back from the 0.8615 area yesterday, however while above the 0.8540 10-month lows, the key day reversal scenario just about remains intact. A break below 0.8530 targets a move towards 0. 8350.

USD/JPY – looks set to retest the recent highs at 140.95, with the potential to move up towards 142.50. Upside remains intact while above 138.30.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.