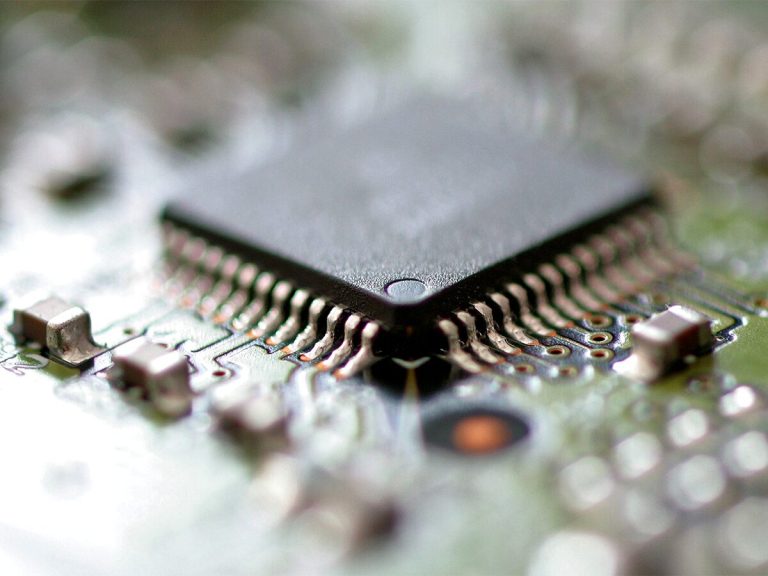

Wall Street finishes mixed after bouncing off a session low following Biden’s administration’s consideration to ban the AI chip export to China. Nvidia and AMD’s shares fell on the news but reversed some losses in the late session. Micron’s shares rose 4% in after-hours trading amid better-than-expected earnings results, lifting sentiment in the sector. Tech stocks again outperformed broad markets, sending Nasdaq higher, while Dow slipped following Fed Powell’s hawkish speech, and S&P 500 was marginally lower.

Central banks’ leaders, including Fed Powell, ECB Lagarde, and BOE Bailey, unanimously insist on hawkish guidance, indicating that the inflation fights are not done, with more rate hikes expected. The BOJ Ueda signalled a possible policy shift as soon as this year if underlying inflation picks up. However, treasury yields did not react to the hawkish stance and slipped broadly, suggesting that markets are seeing the hiking cycle near an end.

Despite a slip in bond yields, the US dollar regained ground, sharply strengthening against the other major G-10 currencies, particularly the Australian dollar and the New Zealand dollar, after Australia reported a sharp decline in inflation on Wednesday.

Asian market may follow through Wall Street’s indecisive moves, with futures pointing to a lower open in most regions. The ASX 200 futures were down 0.06%, the Hang Seng Index futures fell 0.18%, and the Nikkei 225 advanced 0.36%.

Price movers:

7 out of 11 sectors in the S&P 500 finished lower with utility stocks, leading losses, down 1.48%. The energy sector outperformed, up 1.02%. And growth sectors, such as consumer discretionary and communication services also finished higher.

US biggest banks passed the Fed’s annual stress test, weathering a severe recession. The 23 banks are able to continue lending to households and businesses, clearing a hurdle to return billions of dollars to investors through dividends and buybacks.

Micron’s shares rose 4% following better-than-expected fiscal third-quarter earnings. The chipmaker reported earnings per share at a loss of US$1.43, less than an estimated -US$1.58. The revenue was at US$3.75 billion, higher than the US$3.65 billion expected. CEO Sanjay Mehrotra expressed concerns about China’s ban on its export and said it was “a significant headwind that is impacting our outlook and slowing our recovery.”

Australian dollar and New Zealand dollar tumbled following a sharp decline in inflation due to strengthened bets on an RBA’s rate hike pause. The AUD/USD tumbled about 1.3% to just above 0.66. Australian CPI fell to 5.8% annually in May, a sharp decline from 6.8% in the prior month, also lower than an estimated 6.1%.

Crude oil futures rebounded sharply amid a larger-than-expected decline in inventory. The US crude inventory fell by 9.6 million barrels, much less than an expected draw of 1.27 million barrels by the week ending 23 June. WTI futures consolidated above recent key support of 66.60, facing an imminent resistance of the 50-day moving average of 71.84.

ASX and NZX announcements/news:

Turners (ASX/NZX: TRA) reported record revenue of NZ$389.6 million, up 13% annually in FY23, with earnings per share at NZ 37.6 cents, up 3% year on year. The full-year dividend is NZ23 cents or a gross yield of 8.5% per annum.

Today’s agenda:

ANZ Business Confidence for June

Australian Retail Sales for may

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.