Wall Street rose for the third straight trading day as the US bond yields fell from decades-high levels following weak economic data. The US JOLT job openings for July dropped to below 9 million for the first time since May 2021, suggesting the labour market slowed down ahead of the August non-farm payroll data this week. And the CB consumer confidence also unexpectedly pulled back in August. “Bad news is good news,” as the data supported bets for a sooner end of the Fed’s hiking cycle despite the recent hawkish rhetoric of Chairman Powell. The US 2-year bond yields sharply retreated 12 basis points to 4.89%, the lowest in more than two weeks. Tech again was in the lead of the broad-based rally, with all mega-cap companies finishing higher. Tesla jumped 7.7%, and Nvidia rose 4.2% to close at a record high.

The US dollar slumped on falling bond yields, lifting commodity prices higher, with gold up 0.96%, silver jumping 2.1%, and crude oil climbing more than 1%. All the other G-10 currencies saw a sharp rebound against the USD, with the New Zealand dollar strengthening the most on the risk-on sentiment.

Asian markets were also in risk-on mode as China’s state-owned banks may cut mortgage rates for first-home buyers as soon as today. Futures point to a higher open in Asian stock markets, with the Nikkei 225 futures up 0.64%, the ASX 200 futures rising 0.67%, and the Hang Seng Index futures climbing 0.98%.

Price movers:

All 11 sectors finished higher in the S&P 500, with three growth sectors, including Consumer Discretionary, Technology, and Communication Services, leading losses, all up more than 2%. Defensive sectors, such as Utilities and Consumer Staples, were the laggards, up 0.28% and 0.41%, respectively. Energy was also left behind, finishing 0.3% higher.

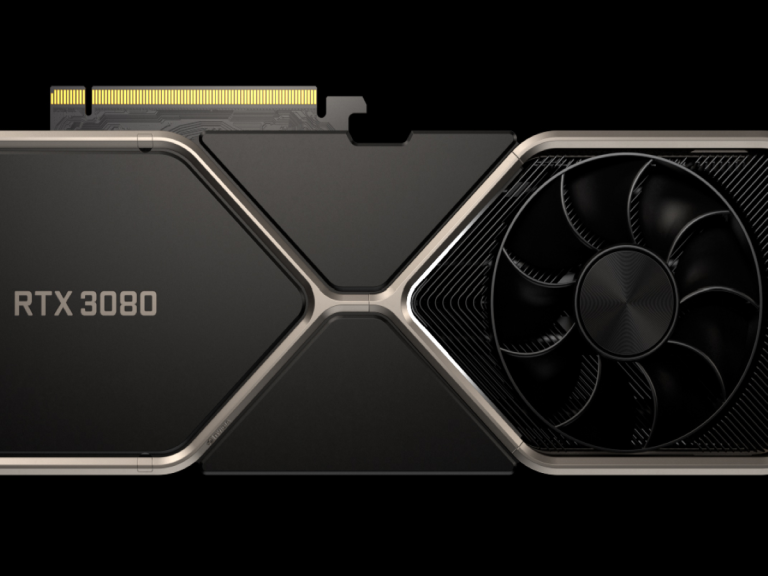

Nvidia’s shares jumped 4.2% after the chipmaker reached an agreement with Google Cloud for its H100 GPUs. The company’s share closed at a record level of just under 488 after briefly hitting above 500 last week following strong earnings report.

NIO fell 1.2% after bouncing a session low of down 5% on the US market amid a weaker-than-expected second-quarter earnings report. The Chinese EV maker lost 6.06 billion yuan (US$835.1 million), or 3.28 yuan (US 45 cents) per share in the second quarter on revenue of 8.77 billion yuan (US$1.21 billion), less than an expected 9.25 billion yuan. The sharp decline was due to a transition to upscale EVs as it sold down the last of outgoing models at substantial discounts, while the new model showed good sales momentum in July.

The Chinese Automaker, BYD’s shares jumped more than 5% amid a two-fold net profit jump in the first half of the year. The largest Chinese EV marker’s net earnings came at 10.95 billion yuan (US$.15 billion). Revenue increased 72% from a year ago, and its sales in new energy vehicles jumped 98% year-on-year to 700,255 units.

Coinbase surged 15%, and Bitcoin rose more than 7% on the news that the US Court of Appeals announced that the SEC was wrong to deny Grayscale to launch its Bitcoin ETF. The decision was seen as positive progress for cryptocurrency’s legislation through mutual funds.

Spot gold rose above the 50-day moving average for the first time since 1 August on falling USD and bond yields. Gold forms a potential double bottom and may head off its high of above 1,970 in mid-July.

ASX and NZX announcements/news:

No major announcement.

Today’s agenda:

NZ Building Consents for July

Australian July CPI

US ADP Non-Farm Employment Change for August

US Prelim Q2 GDP

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.